Accepts pets? Affordable rent? Close to work? Whatever the must-haves are for your next rental home, you can bet there’s a fake listing that checks all the boxes. Since 2020, people have reported nearly 65,000 rental scams to the FTC with about $65 million in losses.[1] And since most scams are never reported to a government agency, this likely reflects only a fraction of the actual harm.[2]

Scammers create fake rental listings that look very real. They often do this by copying legit listings, changing the contact information so you reach them instead of the real landlord, and posting their fake listing on a different site. In fact, many would-be renters report discovering that the scammer copied an ad for a property that was really for sale, not for rent. Other scammers create fake listings from scratch, complete with attractive photos and below market rent to grab your attention.

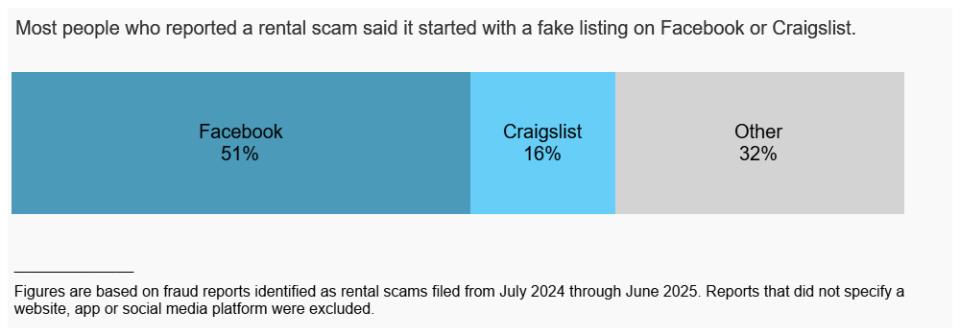

While these scams show up on many websites, Facebook is the most reported platform. In the 12 months ending in June 2025, about half of people who reported a rental scam said it started with a fake ad on Facebook.[3] Another 16% said the scam started with a fake listing on Craigslist.

Reports show these scams can take a few different forms:

- Scammers pressure you for money upfront before you’ve even seen the place in person. They might say you need to pay an application fee, security deposit, or first month’s rent to “hold” the property.

- Scammers say you need to show you’re creditworthy by sending screenshots of your credit scores. They send links to websites that let you sign up for a credit check, often for $1. You might not realize that enrolls you in a paid membership with recurring fees, or that the scammer makes money as an “affiliate” for each enrollment.

- Scammers collect personal information to steal your identity. They tell you to complete an application with information like your Social Security number, a picture of your driver’s license, paystubs, and other personal details that they can use to steal your identity.

As a rule, these scammers will not meet you in person to show the property, but they may set you up with a self-guided tour to help convince you they’re legit. They do this by copying listings from landlords who use self-tour services. Then they send you a code (or tell you how to get one) to open a lockbox holding the keys. Reports show, however, that scam warnings sometimes posted inside these homes have helped tip some people off.

Rental scams can happen to anyone, but reports suggest young people are the hardest hit. People ages 18 to 29 were three times more likely than other adults to report losing money to a rental scam.[4] Many young adults report being targeted on Facebook groups college students use to look for sublets and other housing options close to campus.

What rental scammers have in common is that they disappear, leaving you without the home you planned for. These scammers also make it harder for real landlords, many of whom report seeing their listings copied to defraud people.

What are some things you can do to spot and avoid these scams while searching for your next home?

- Search the rental address online. If you find the same property listed with different prices or contact information, it’s likely a scam. And if you find the home listed for sale instead of for rent, that’s a big red flag.

- Don’t share personal information too early. Until you’ve agreed to rent a place, a landlord doesn’t need your Social Security number, credit score or other sensitive information. And legit landlords normally pull your credit score themselves – they don’t tell you to get it for them.

- Look into typical rents nearby. If the advertised rent is a lot cheaper than most rents in the area, it could be a sign of a scam. And if anyone pressures you to make a decision quickly to get a great deal, walk away.

Learn more about rental scams. To spot and avoid scams – and learn how to recover money if you paid a scammer – visit ftc.gov/scams. Report scams to the FTC at ReportFraud.ftc.gov.

[1] A text classification model was used to identify rental scam reports based on patterns in report narratives consistent with likely rental scams. These figures are based on fraud reports to the Consumer Sentinel Network filed from January 2020 through June 2025 that were identified as rental scams. The median reported loss amount during this period was $1,000. Reports filed by Sentinel data contributors were excluded here and throughout this Spotlight.

[2] See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021) (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity).

[3] Reports that did not specify a website, app or social media platform were excluded.

[4] This comparison of reporting rates by age is based on reports filed from July 2024 through June 2025 and normalized based on the population size of each age group using the Census Bureau’s 2019-2023 American Community Survey 5-Year Estimates. The share of reports indicating a monetary loss filed by each age group during this period is as follows: 46% (18-29), 23% (30-39), 13% (40-49), 9% (50-59), 6% (60-69), 2% (70-79), less than 1% (80 and over). This excludes reports that did not include consumer age information.